Best Forex Brokers & Platforms – Top 10 Brokers 2021

A forex broker is a company that offers currency instruments to clients, which can be traded using a forex trading platform. Here we explain everything you need to know to compare forex brokers and their trading platforms. In our list of the best forex brokers, we have considered a wide range of factors, from fees and spreads to trading platforms, charting and analysis options.

Best Forex Brokers in Belarus

How To Find The Best Forex Brokers

Below we’ve listed the main criteria for finding the best forex brokers 2021. We will expand on each area later on in the article.

- Fees/Commission – This is the most important part of your global forex broker appraisal. One forex platform may charge you a tenth of the price for the same trade vs another. Take note of “hidden” fees, such as withdrawal or inactivity fees.

- Operating Model – Forex brokers usually operate one of two operating models: dealing desk or no dealing desk. A dealing desk broker owns its order book, meaning they create liquidity for clients. These are known as ‘market makers’ because if there is no one to take the other side of a trade (i.e buy what you’re selling), they’ll take it themselves. No dealing desk brokers (also known as ECN brokers) connect to a larger market where filling orders is not an issue.

- Market Coverage – The selection of assets on offer. Does the forex platform provide the FX pair or product you’re looking for?

- Accessibility and Affordability – Beginner forex traders and small-timers need love too. You should never be forced into making a minimum deposit that you cannot afford to lose. Minimum deposits range from $10 to $1000 (or the £/€ equivalent). It might be worth investing more for a platform that suits you better, so stay open-minded.

- Platforms – The forex trading platform and the tools it provides are your primary weapons in your personal war for profits. Personal preference will play a large part here, as many platforms offer very similar services, but look and feel very different. Remember many platforms are configurable, so they can be tailored to suit your needs.

- Strategies – Not all forex brokers allow every strategy. For instance, it’s common to see limitations on scalping, hedging and automated trading strategies (EAs). If this is what you’re interested in, you’ll need to check before you sign up that you’re selecting a forex broker for scalping, for example.

- Mobile Apps – Being able to trade on the go may be important. Some mobile apps are superior to others. Usually, the features available on desktop are not matched on a mobile app, so access to both is recommended.

- Deposits and Withdrawals – The ability to move funds to and from the platform, quickly and preferably cheaply is key. Forex brokers with instant deposits for debit/credit cards and PayPal are common, so look out for these where possible.

- Reputation – People talk. It is well worth listening to what traders say about their forex broker.

- Regulation – A proper regulatory framework is key. It gives you the reassurance that the forex platform is operating within the rules the governing body has assigned. This provides an element of trust between broker and client.

- Customer Support – You need someone to talk to if you run into problems. Competent support is a must. From opening an account, to help with the platform – customer support is important.

- Company Background and History – Knowing the past exploits of forex brokers can give you a better idea of what it is up to now. A listed company has to publish numerous elements of information about their balance sheet, for example.

- Education – It never hurts to improve your understanding of how the forex markets work. Some brokers offer extensive educational tools that will enable you to take advantage of movements when they occur.

- Account Opening/Registration – Is it a simple process to open an account? Do clients need to be verified? These processes are not always the same and might be worth considering if opening an account has been problematic in the past.

Broker Costs

The services that forex platforms provide are not free. You pay for them through spreads, commissions and rollover fees.

The fee structures differ from one forex broker to another, and even from one account type to another. There are two widely used basic setups.

- Spread Only – All other fees (with the exception of the rollover rate) are included in the spread

- Blend Of Fees – Besides the spread, a commission may be charged as well

Spreads

Most forex brokers make money through spreads on currency pairs. This can be either fixed or variable. Fixed spreads are always constant, regardless of market volatility. Variable spreads change, depending on the traded asset, volatility and available liquidity.

Daily spreads may only differ slightly among forex platforms, but active traders (or even hyper-active traders) are opening positions so frequently that small differences can mount up.

Traders should always be looking for forex brokers with the lowest spread. 1 pip fixed spread forex brokers are out there and ECN brokers may even deliver zero spreads.

Commission

A commission-based fee structure usually suits other tradable assets, such as stocks and shares. However, you may encounter an instance where a commission is charged by forex brokers. Use a profit calculator to understand whether low spreads make up for this.

Rollover Rate

Forex positions kept open overnight incur an extra fee, known as a rollover rate. This charge results from the difference between the interest rates of the two currencies.

Assets

While most forex brokers offer an impressive-looking selection of currency pairs, not all of them cover minors and exotics.

For example, if you want to trade Thai Bahts or Swedish Krone, you will need to double-check the asset lists and tradable currencies. These currencies are less commonly traded and therefore may not be offered by all platforms.

If you’re interested in major pairs (see below), then all brokers will cater for you.

The Aussie dollar and Swiss Franc, while considered ‘minor’ pairs, are often traded in high volume. You can read more about those here: AUD/USD or USD/CHF

That said, there are brokers out there that will truly go out of their way to cater to their traders’ needs. Some will even add international exotics and currency markets on request. Such flexibility is obviously a major asset.

What About Crypto?

Cryptocurrency pairs are ubiquitous nowadays. Crypto/fiat and crypto/crypto pairings are both popular.

The massive volatility associated with these products makes scalping a viable strategy for profitability.

Forex brokers do not usually offer spot crypto, instead, they’ll trade CFDs. The regulation of cryptocurrency varies globally. For example, for US residents, there are often difficulties accessing some of the largest exchanges due to SEC regulation. And, in the UK, all crypto derivatives are banned.

Micro Accounts

Not everyone trades forex on a massive scale. In fact, many forex traders are small-timers. These clients require forex platforms’ micro accounts, some of which have the US Dollar as their base currency.

Often, forex micro accounts do not even have a set minimum deposit requirement. Such cheap trading options make sense for those looking to use real money, without risking their life savings.

Forex Trading Platforms

Besides fees, a forex broker’s trading platform is one of its largest selling points. Platforms are your portal into the investing world – giving you the ability to open and close trades but also monitor price changes and complete analysis.

They provide traders with technical analysis tools, live news feeds, diverse order types, automation, advanced charting and drawing options etc. Some may include sentiment indicators or event calendars.

We’ve provided an overview and comparison of the top trading platforms used by forex brokers below.

MetaTrader 4

MetaTrader 4 (MT4) is the original platform created by MetaQuotes. It has set many of the standards we’ve come to expect today for online analysis.

It’s famous for its in-depth analytics, which go way beyond the usual graphs and charting you’d expect. In fact, all in all, you can bring 31 different graphical studies to your results, including Fibonacci studies and Elliot wave drawing tools.

Plus, it was also one of the first to deliver analytics to mobile. You can access almost all these powerful tools on your phone just as easily as you can on a desktop.

MetaTrader 4

Read a more in-depth analysis of MetaTrader 4 here.

MetaTrader 5

It’s five years younger and sounds like an upgrade, but in fact, MT5 isn’t considered to be the better version of MT4. It really depends on what you want it for.

MT5 is geared more towards the US market and automatically complies with more US regulations than MT4 does.

While it’s true that it has more bells and whistles, like 44 graphical studies instead of 31, it’s really set up to deal better with high frequency automated trading. If that’s what you’re looking to do, then MT5 is for you, but if you’re not then you may find most of these additional features unnecessary and bulky.

The base operating software on MT4 is not thought to run any slower than MT5, so think of it more like a slimline version of the same thing with more of what you need, and less of what you don’t.

MetaTrader 5

Forex brokers will usually offer both MT4 and MT5 as options. Although, MetaQuotes have stopped selling licences for MT4, so new brokers may not offer this.

Read a more in-depth analysis of MetaTrader 5 here.

Other Popular Platforms

TradingView is also a popular choice that consistently ranks within the top 10 platforms. As the world’s top social trading network, it’s used by numerous forex brokers and is especially popular among professional investors.

NinjaTrader is praised for its advanced features and technical analysis tools. In particular, the NinjaTrader Ecosystem allows access to thousands of apps, EAs, and other add-ons created by external developers.

Bespoke Proprietary Platforms

Another popular option for forex trading platforms is the bespoke route. Many forex brokers will offer their own “home-made” proprietary platforms alongside the usual MT4 and MT5 solutions.

The great benefit of these is that they’re usually designed specifically around a certain kind of market, strategy or currency pair. In this way, you’ll find they can often be better suited to your specific needs. But at the same time, they can be less versatile.

Proprietary solutions are in some cases less than optimal. Traders who base their strategies on the use of EAs and VPS, will struggle to find a proprietary platform that compares to MT4 and MT5. In fact, many do not offer the functionality altogether.

While we are discussing strategies: not all forex brokers support strategies such as hedging, scalping and EAs. Make sure you understand any and all restrictions in this regard before you sign up.

Mobile App

For those who want to trade on the go, a mobile app is obviously important. While all forex brokers feature such apps these days, some mobile platforms are very simplistic.

They lack all the advanced analysis and market research features, and as such, are hardly useful.

MT5 mobile

Software

The developers of trading software are often adding new and unique functionality to their platforms. But some also allow user-developed AI or tools to be added. In fact, many allow users to load their own functionality to a ‘code base’ (in the case of MT4) where other users can then download those add-ons for free. This added configurability is very attractive for certain traders.

The majority of ‘off the shelf’ software falls into two camps: signals or automated trading robots (‘bots’).

Signals

Signal platforms, as the name suggests, are set up to alert the user when certain market conditions are met.

Within this type of software, you can dictate when you receive signals and how they are sent. Speed is crucial when using signals.

The major advantage to using this type of software is that you don’t have to sit in front of a market ticker watching currency fluctuations day and night or keep yourself plugged into world politics, because you’ll be alerted to price targets as they are reached. Systems can also be configured to recognise certain patterns.

Signals can add some discipline to trading, as, in theory, trades will only be placed when certain conditions are met – reducing any made on impulse. This is a double-edged sword, though, because it still relies on your judgement to make the correct decision once the signal has been sent.

Automated Trading

Automated trading software takes forex signals to the next logical step. Not only will opportunities be identified (based on your configuration) but the trades will also be automatically placed as per your commands.

While this might sound easier than a signal platform, if you’re going to do it properly, it requires a huge amount of homework and fine-tuning before you’re ready to set the algorithm free in the markets for it to start making you money.

Put simply, the automated forex trading software systems – called robots or bots – will trade your money using a pre-determined set of entry and exit criteria that you decide in advance.

There are apps that you can download to check the progress of your forex bots on the move, but fundamentally it is up to them to make the right trades.

In comparison to signal platforms, the frequency of trades placed by automated forex platforms cannot be matched. This is because bots can execute faster than any human – and they can do so 24/7.

This means there is far more potential to make money, but you’re also exposing yourself to far more risk.

The robot will follow the trading rules until the balance runs out, and that can all happen very quickly if things start going wrong. Automated forex trading platforms are a domain for the experienced trader only.

Tools & Features

From charting to futures pricing or bespoke trading robots, forex brokers offer a range of tools to enhance the experience.

Again, the availability of these as a deciding factor on opening account will be down to the individual.

Level 2 (or Level II) data is one such tool, where preference might be given to a brand delivering it.

Education

Some traders may rely on their forex broker to help them learn to trade. From guides to classes and webinars, educational resources vary from brand to brand.

However, a broker is not always the best source for impartial advice. Consider checking other sources too – such as our Education page.

Deposits and Withdrawals

There are some massive disparities between the costs associated with deposits and withdrawals from one broker to another. Such disparities mostly result from the internal procedures observed by different forex brokers.

At one platform, it can take as much as 5 times longer to fund an account than at another. The incurred costs differ quite a bit as well.

Otherwise, the payment process largely hinges on the accepted money transfer methods. It would make sense for forex brokers to adopt as many such methods as possible, yet some still fall well short of the mark.

Most forex brokers also specify minimum deposits with their accounts, which can range from $10 to $10,000. This can act as an entry barrier to less experienced clients with less capital to invest.

Payment Methods

The most common methods are bank wire, VISA and MasterCard. The majority of forex platforms tend to accept Skrill and Neteller too.

Forex brokers with PayPal are much rarer. The same goes for forex brokers accepting bitcoin.

We are not talking about bitcoin trading, but actual deposits made in the top cryptocurrency.

Customer Feedback

Based on actual user feedback, a forex broker’s reputation can best be gleaned from various community review sites and forums.

You have to take this type of feedback with a grain of salt, to say the least.

First of all: disgruntled traders are always more motivated to post feedback. They are not likely to be unbiased.

Secondly: not all of this feedback is factually correct. Furthermore, there is no way to actually fact-check/verify this data. Even sites like TrustPilot are blighted with fake posts or scam messages. There is no quality control or verification of posts.

That said, it is still relevant. If there’s a forex broker about which no one has ever said anything good, chances are it might have issues. To the trained eye, genuine trader reviews are relatively easy to spot.

The utter lack of community feedback is red flag as well. People always have something to say about forex brokers. Therefore, something is definitely amiss if there is no information available in this regard.

Regulation

Regulation should be an important consideration. Across the world, there are different regulatory bodies that govern the rules a forex broker must adhere to. Forex brokers regulated in Russia, Canada, UAE (Dubai) or Pakistan may have different responsibilities to those in the USA, Philippines or South Africa, for example.

Europe

In Europe, ESMA (the European Securities and Markets Authority) has jurisdiction over all regulators within the European Economic Area (EEA). This includes the following regulators:

-

(Cyprus Securities and Exchange Commission) – (Bundesanstalt für Finanzdienstleistungsaufsicht) (Swiss Financial Market Supervisory Authority)

If a forex platform is regulated by one of the above, they are permitted to provide financial services throughout Europe. Therefore, you’ll often find that forex brokers are regulated by CySEC, but accept clients from Germany, Switzerland and the rest of Europe.

In Europe, forex leverage is capped at 1:30 (or x30). Outside of Europe, leverage can reach 1:500 (x500).

Traders in Europe can apply for professional status with their forex broker. This removes their regulatory protection and allowing them to trade with higher leverage.

Other rules include the duty for forex brokers to display warnings about the “risk of losing all your money” when CFD trading and the ban on offering binary options.

Other Global Regulators

Outside of Europe, the largest regulators of forex brokers are:

-

– Securities and Exchange Commission (US) – Commodity Futures Trading Commission (US) – Financial Conduct Authority (UK) – Canadian Securities Administration – Australian Securities and Investments Commission

These are the most stringent global regulators. Forex brokers offering services in their jurisdictions must register with them to provide financial services legally. In other nations, the regulators are more laisse faire and regulation is not mandatory. Therefore, forex platforms operating in India, Hong Kong, Ghana, Kenya, Qatar etc. are likely to be regulated in one of the above, rather than their national regulator.

Offshore Regulation

Regulators based in Vanuatu, Belize and other island nations are called ‘offshore regulators’. Sadly, this is not a sign that should instil confidence in the forex broker. Beyond a nominally available dispute-resolution system, such regulatory coverage offers you no protection.

Leverage

Leverage can be a factor to consider when selecting forex platforms. However, regulation often takes the choice out of this. Leverage is capped at 1:30 by the majority of forex brokers regulated in Europe. Assets such as gold, oil or stocks are capped separately.

Note that higher leverage increases potential losses, as well profits.

Security

Most forex brokers will follow regulations and segregate client and company funds into separate bank accounts. This protects traders in the case of broker liquidation.

Data protection is usually legislated at a government level. In the EU, GDPR regulation applies. This restricts what forex brokers can do with your personal data, offering that added level of protection.

Account security also differs among forex brokers. Some platforms may offer the additional layer of protection of 2FA (two-factor authentication) which will protect against hacker intrusion.

Demo Accounts

If this is all sounding like too much already and you’re feeling daunted, you can ‘try before you buy’ using a demo account. Many forex brokers will allow you to open a simulation account. This trading training software uses imaginary money to see how you would have performed had you made the decisions that you did on the real forex market.

This can be good for new traders looking to test the waters and ease their nerves, and it can also be useful for more experienced traders looking to trial new strategies and ideas in a risk-free environment. It’s the best ‘on the job’ training that you can get. The best forex trading platforms for beginners will offer this function, and it’s highly recommended that you give it a go. It’s a real advantage.

Company History

A proper regulatory agency will not think twice about handing out cease and desist orders to dishonest brokers. It will also likely blacklist them.

This practice creates an online trail, an operational history of sorts, highlighting the past sins of currently “reputable” forex brokers.

What’s interesting about this history is how little exposure it receives. You actually have to scour the archives of regulators to happen upon such relevant bits of information.

Bonus Offers

From cashback, to a no deposit bonus, free trades or deposit matches, forex brokers used to offer loads of promotions. Regulatory pressure has changed all that.

Forex platforms offering bonuses are now few and far between. Our forex bonus page will list them where offered, but they should rarely be a deciding factor in your choice.

Always check the terms and conditions and make sure they will not cause you to over-trade. Many forex brokers with welcome, low or no deposit bonuses have time limits or turnover requirements. This is particularly crucial when assessing a forex broker offering a no deposit bonus. Often, bonuses that are given without the need to deposit are non-withdrawable.

Order Execution Types

Once you click the “Open Trade” or “Enter” button in your trading interface, you start a rather intricate process. Forex brokers use a number of different methods to execute your trades.

Exactly which method it uses for a particular trade will be reflected in the price you pay for it. Some forex platforms only support certain order execution methods. For instance, your broker may act as a market maker and not use an ECN for trade execution.

If you are looking for this method specifically, you will need to seek out an ECN forex broker.

ECNs are great for limit orders, as they match buy and sell orders automatically within the network.

Some other options that your forex broker can use are:

- Order To The Floor – Mostly used for stocks. This execution type is handled manually, through actual trading floors/regional exchanges. It is therefore extremely slow.

- Order To Third Market Maker – This execution type involves a third party, which is a market maker. The market maker handles trade execution. Some market makers pay brokers to send them orders. Thus, your order may not end up with the best market maker.

- Internalization – When using this method, forex platforms match the order from its own inventory of assets. This execution method is therefore extremely fast.

Order execution is extremely important when it comes to choosing forex brokers. It also goes hand-in-hand with regulatory requirements.

Broker Reporting

Regulators aim to make sure that traders get the best possible execution. In fact, forex brokers in Europe and the US are required by ESMA and the SEC to report the quality of the execution their services provide.

MiFID II sets clear guidelines in this regard. Online forex brokers are required to submit data concerning their execution methods as well as execution prices on a trade-by-trade basis.

In this reporting, the prices paid by forex platforms are compared to those quoted to the public. If the broker executes trades at better prices than the public quotes, it has some additional explaining to do. Plus, if it routes the trader’s order through a less-than-optimal path, it has to disclose this fact to the trader.

These examples yet again showcase the importance of a proper regulatory background.

Forex Account Types

From cash, margin or PAMM accounts, to Bronze, Silver, Gold and VIP levels, account types can vary. The differences can be access to 0 pip spreads, Level II data, settlement or different leverage and commission. Comparison is recommended to ensure you’re getting the best deal for your capital allowance.

Micro accounts might provide lower trade size limits for example.

Retail and professional accounts will be treated very differently by both brokers and regulators for example. An ECN account will give you direct access to the forex contracts markets.

So research what you need, and compare it to what you are getting at your current forex platforms.

Scams

Sadly, there are some forex brokers that are just scams. Avoid getting caught out with these checks:

- Were you ‘cold called’? Reputable firms will not call you out of the blue (this includes emails, Facebook or Instagram channels)

- Are they offering unrealistic profits? Just stop and consider for a minute – if they could make the money they are claiming, why are they cold calling or advertising on social media?

- Are they offering to trade on your behalf or use their own managed or automated trades? Do not give anyone else control of your money.

If you have any doubts, simply move on. There are plenty of legitimate, legal brokers.

We have ranked forex brokers and platforms based on our own opinion and offered ratings in our tables, but only you can award ‘5 stars’ to your favourite!

Read who won the DayTrading.com ‘Best Forex Broker 2021‘ on the Awards page.

Difference Between A Broker And A Market Maker?

Forex brokers are intermediaries. Their primary (and often only) goal is to bring together buyers and sellers by matching orders automatically, without human intervention (STP). For this service, it collects its due fees.

Market maker forex brokers, on the other hand, actively create liquidity in the market by acting as a counterparty to traders. If there’s no one to take the other side of your trade (buy when you’re selling), they’ll take the other side of the trade. This does lead to a conflict of interest. Market makers will be profiting from your losses.

The Bottom Line

Hopefully, you now understand some of the methods we’ve used to create our forex brokers ranking list.

Picking the right platforms for you from the extensive list of forex brokers is no easy task. But it is imperative that you get it right. While we can point you in the correct general direction, only you know your personal needs. Take them into account, together with our recommendations.

Reviews of Forex Brokers & Platforms

Use this table with reviews of the top forex brokers to compare all the FX platforms we have ever reviewed. Note that some of these forex brokers might not accept accounts opened from your country.

If we can determine that a broker or platform would not accept your location, it is marked in grey in the table.

| Broker | Demo | Min Dep. | MT4 | Bonus |

|---|---|---|---|---|

| 101investing | Yes | $250 | Yes | No |

| 12Trader | Yes | $500 | No | No |

| 4xCube | Yes | $10 | Yes | No |

| 5paisa | No | INR 450 | No | No |

| A+ Trader | No | $100 | Yes | Yes |

| AAAFx | Yes | $300 | Yes | Yes |

| AccentForex | Yes | $50 | Yes | Yes |

| ActivTrades | Yes | $500 | Yes | Yes |

| Admiral Markets | Yes | $100 | Yes | No |

| AdroFX | Yes | $25 | Yes | Yes |

| ADS Securities | Yes | $100 | Yes | No |

| AETOS | Yes | $250 | Yes | Yes |

| AGEA | Yes | $1 | Yes | Yes |

| Ally Invest | No | $0 | No | No |

| Alpari | Yes | From $/£/€ 5 | Yes | Yes |

| Alpha FX | No | N/A | No | No |

| Alpho | Yes | $100 | No | No |

| Alvexo | Yes | 500 EUR/USD | Yes | No |

| Amana Capital | Yes | $50 | Yes | Yes |

| AMarkets | Yes | $100 | Yes | Yes |

| Angel Broking | Yes | $0 | No | No |

| ArgusFX | No | $0 | Yes | No |

| Arum Capital | Yes | $500 | No | No |

| AskoBID | No | €250 | No | No |

| ATC Brokers | Yes | $5,000 | No | No |

| Atiora | Yes | $1 | Yes | Yes |

| AvantGardeFX | Yes | $500 | Yes | No |

| Avatrade | Yes | $100 | Yes | No |

| Axes | Yes | $100 | No | No |

| Axi | Yes | 0 $/€/£ | Yes | No |

| Axiory | Yes | $10 | Yes | Yes |

| Ayondo | Yes | £1 | Yes | No |

| BCS Forex | Yes | $1 | Yes | Yes |

| BDSwiss | Yes | 100 $/€/£ | Yes | No |

| Binarium | Yes | $5 | No | No |

| Binary.com | Yes | $5 | Yes | No |

| BlackBull Markets | Yes | $200 | Yes | No |

| Blackwell Global | Yes | $250 | Yes | No |

| BMFN | Yes | $50 | Yes | No |

| BP Prime | Yes | $5,000 | Yes | No |

| Brokereo | Yes | $250 | Yes | No |

| Bulbrokers | Yes | $100 | Yes | No |

| BUX X | Yes | $50 | No | No |

| Capex | Yes | $100 | No | Yes |

| Capital Index | Yes | $100 | Yes | Yes |

| Capital.com | Yes | £/$/€20 (Varies by payment method) | Yes | No |

| CGS-CIMB | Yes | 100 SGD | Yes | No |

| City Credit Capital | Yes | $500 | Yes | No |

| CityIndex | Yes | £/$100 | Yes | Yes |

| CIX Markets | Yes | $500 | Yes | No |

| CMC Markets | Yes | £ 0 | Yes | No |

| CMSTrader | Yes | $500 | No | No |

| CMTrading | Yes | $250 | Yes | No |

| Colmex Pro | Yes | $500 | Yes | No |

| Core Spreads | Yes | $0 | Yes | No |

| Corsa Capital | Yes | $1 | No | Yes |

| CPT Markets | Yes | $100 | Yes | No |

| CrescoFX | Yes | $1,000 | Yes | No |

| Cryptobo | No | 0.0000001 BTC | No | Yes |

| Daniels Trading | Yes | $2,000 | No | No |

| Darwinex | Yes | $500 | Yes | No |

| DeltaStock | Yes | $100 | Yes | Yes |

| Deriv.com | Yes | €/£/$5 | No | No |

| DIF Broker | Yes | Undisclosed | No | No |

| DirectFX | No | $100 | Yes | No |

| DMM FX | Yes | Undisclosed | Yes | No |

| Dsdaq | Yes | 0.001 BTC/BCH/LTC | No | Yes |

| Dukascopy | Yes | $100 | Yes | Yes |

| EagleFX | Yes | $10 | Yes | No |

| Easy Markets | Yes | €100 | Yes | No |

| Eightcap | Yes | £/€/$100 | Yes | No |

| Equiti | Yes | $500 | Yes | No |

| ETFinance | Yes | $250 | Yes | No |

| eToro | Yes | $200 ($50 in US) | No | No |

| ETX Capital | Yes | £250 | Yes | No |

| EuropeFX | Yes | €200 | Yes | No |

| EuroTrader | Yes | $0 | Yes | No |

| EverFX | Yes | $250 | Yes | Yes |

| eXcentral | No | $250 | Yes | No |

| Exinity | No | $10,000 | Yes | No |

| Exness | Yes | $1 | Yes | Yes |

| EZ Invest | Yes | $500 | Yes | No |

| FBS | Yes | $1 | Yes | Yes |

| FCMarket | Yes | $500 | Yes | No |

| FIBO Group | Yes | $50 | Yes | No |

| Finalto | Yes | $100 | Yes | Yes |

| Financial Spreads | Yes | £250 | No | No |

| Financika | No | $200 | No | Yes |

| Finexo | Yes | $100 | Yes | No |

| Finotrade | Yes | $1,000 | Yes | No |

| Finq.com | Yes | $100 | Yes | No |

| Finspreads | Yes | £50 | No | No |

| Fondex | Yes | $0 | No | No |

| Forex.com | Yes | $100 | Yes | No |

| Forex4you | Yes | $0 | Yes | Yes |

| ForexChief | Yes | $10 | Yes | Yes |

| ForexMart | Yes | 1 EUR/USD | Yes | Yes |

| ForexTB | Yes | $250 | Yes | No |

| FortFS | Yes | $5 | Yes | Yes |

| Fortrade | Yes | $100 | Yes | No |

| FP Markets | Yes | $100 | Yes | No |

| FreshForex | Yes | $10 | Yes | Yes |

| Fullerton Markets | Yes | $100 | Yes | Yes |

| Fusion Markets | Yes | $0 | Yes | No |

| FXCC | Yes | $0 | Yes | No |

| FXChoice | Yes | $100 | Yes | Yes |

| FXCM | Yes | £300 | Yes | No |

| FXDD | Yes | $/£1 | Yes | No |

| FXFlat | Yes | €200 | Yes | No |

| FXGiants | Yes | $100 | Yes | Yes |

| FxGlory | Yes | $1 | Yes | Yes |

| FXGM | No | $200 | No | No |

| FxGrow | Yes | $100 | No | No |

| FxNet | Yes | $50 | Yes | No |

| FXOpen | Yes | $300 | Yes | Yes |

| FXPIG | Yes | $200 | Yes | No |

| FXPrimus | Yes | $100 | Yes | No |

| FXPro | Yes | $100 | Yes | No |

| FXTM | Yes | From $50 | Yes | Yes |

| FXTrading | Yes | $200 | Yes | Yes |

| GCI | Yes | $500 | Yes | Yes |

| GKFX | Yes | €100 | Yes | No |

| Global Market Index | Yes | $2,000 | Yes | No |

| Global Prime | Yes | AUD $200 | Yes | No |

| GO Markets | Yes | $200 | Yes | Yes |

| GoStreams | Yes | $100 | Yes | No |

| Grand Capital | Yes | $10 | Yes | Yes |

| Hantec Markets | Yes | $0 | Yes | No |

| HFTrading | Yes | $250 | Yes | No |

| Hirose | Yes | $20 | Yes | Yes |

| HotForex | Yes | $100 | Yes | No |

| House Of Borse | Yes | $5,000 | Yes | No |

| HQBroker | No | $250 | Yes | No |

| Hugo’s Way | Yes | $50 | Yes | No |

| HYCM | Yes | $100 | Yes | Yes |

| IC Markets | Yes | $200 | Yes | No |

| ICE FX | Yes | $30 | Yes | No |

| ICM Brokers | Yes | $300 | Yes | No |

| ICM Capital | Yes | $200 | Yes | No |

| IFC Markets | Yes | 1 USD / 1 EUR / 100 JPY | Yes | Yes |

| IFGM | Yes | $200 | Yes | No |

| iFOREX | Yes | $100 | No | No |

| IG Group | Yes | £250 | Yes | No |

| Infinox | Yes | £1 | Yes | No |

| InstaForex | Yes | €1 to €1000 (Account choice dependent) | Yes | No |

| Interactive Brokers | Yes | $10000 | No | No |

| InterForex | Yes | $500 | No | Yes |

| Intertrader | Yes | $500 | Yes | Yes |

| Investous | Yes | $250 | Yes | No |

| IQ Option | Yes | $10 | No | No |

| IronFX | Yes | $100 | Yes | Yes |

| ITradeFX | Yes | $0 | No | No |

| JFD Bank | Yes | $500 | Yes | No |

| JP Markets | Yes | $0 | Yes | Yes |

| Juno Markets | Yes | $100 | Yes | Yes |

| Just2Trade | Yes | $100 | Yes | No |

| JustForex | Yes | $1 | Yes | Yes |

| Key To Markets | Yes | $100 | Yes | No |

| Khwezi Trade | Yes | R 2,000 | Yes | No |

| KLMFX | Yes | $250 | No | Yes |

| Land FX | Yes | $300 | Yes | Yes |

| Larson & Holz | Yes | $250 | No | Yes |

| LBLV | Yes | $5,000 | No | Yes |

| LCG | Yes | 0 $/€/£ | Yes | No |

| LDC | Yes | $100 | Yes | No |

| LegacyFX | Yes | $500 | No | No |

| LH Crypto | Yes | €10 | No | No |

| Libertex | Yes | €100 | Yes | No |

| LiteForex Europe | Yes | $50 | Yes | No |

| LiteForex Investments | Yes | $50 | Yes | Yes |

| Livemarkets | Yes | $250 | Yes | No |

| LMFX | Yes | $100 | Yes | Yes |

| LQDFX | Yes | $20 | Yes | Yes |

| M4Markets | Yes | $5 | Yes | Yes |

| Markets.com | Yes | $100 | Yes | No |

| Mega Trader FX | Yes | $0 | Yes | Yes |

| Mitto Markets | Yes | $0 | Yes | No |

| Moneta Markets | Yes | $200 | Yes | Yes |

| MTrading | Yes | $100 | Yes | Yes |

| MultiBank FX | Yes | $50 | Yes | Yes |

| Nadex | Yes | $0 | No | Yes |

| Naga | Yes | $250 | Yes | No |

| NBH Markets | Yes | $100 | Yes | No |

| NicoFX | Yes | $100 | Yes | No |

| NinjaTrader | Yes | $50 | Yes | No |

| Noble Trading | Yes | $100 | Yes | Yes |

| NordFX | Yes | $10 | Yes | No |

| NPBFX | Yes | $10 | Yes | Yes |

| NSFX | Yes | $300 | Yes | No |

| Oanda | Yes | $0 | Yes | No |

| OBR Invest | Yes | $250 | Yes | No |

| OctaFX | Yes | $100 | Yes | Yes |

| Optimus Futures | Yes | $500 | Yes | No |

| Orbex | Yes | $200 | Yes | No |

| OspreyFX | Yes | $25 | Yes | No |

| Pacific Union | Yes | $50 | Yes | Yes |

| PaxForex | Yes | $10 | Yes | Yes |

| Pepperstone | Yes | £200 / $200 | Yes | No |

| Plus500 | Yes | $100 | No | No |

| Price Markets | Yes | $5,000 | Yes | No |

| PrimeXBT | No | 0.001 BTC | No | No |

| ProfitiX | No | $250 | No | No |

| Q8 Trade | Yes | $250 | Yes | Yes |

| Questrade | Yes | $1,000 | No | Yes |

| Quotex | Yes | $10 | No | Yes |

| RoboForex | Yes | $10 | Yes | Yes |

| RoboMarkets | Yes | $/£/€100 | Yes | No |

| ROInvesting | Yes | $250 | Yes | No |

| Sage FX | Yes | $10 | Yes | Yes |

| Saxo Bank | Yes | $10000 | No | No |

| Sharekhan | No | $0 | No | No |

| Sheer Markets | Yes | $200 | Yes | No |

| SimpleFX | Yes | $0 | Yes | Yes |

| Skilling.com | Yes | 100 £/€/$ or 1000 NOK, SEK | Yes | No |

| Smart Prime FX | Yes | $25,000 | Yes | No |

| SmartFX | Yes | Undisclosed | No | No |

| Spectre.ai | Yes | $0 | No | No |

| Spread Co | Yes | £200 | No | No |

| Spreadex | No | $1 | No | No |

| SquaredFinancial | Yes | $100 | Yes | No |

| Stratton Markets | Yes | £250 | Yes | No |

| StreamsFX | Yes | $500 | Yes | No |

| Superforex | Yes | $1 | Yes | No |

| SVK Markets | Yes | $100 | Yes | No |

| Swissquote | Yes | $1,000 | Yes | No |

| SynergyFX | Yes | $50 | Yes | Yes |

| TD Ameritrade | Yes | $0 | No | Yes |

| TeleTrade | Yes | 100 EUR/USD | Yes | No |

| TeraFX | Yes | $100 | Yes | No |

| ThinkMarkets | Yes | $0 | Yes | No |

| Tickmill | Yes | $100 | Yes | Yes |

| Tier1FX | Yes | $1,000 | Yes | No |

| TIO Markets | Yes | $50 | Yes | No |

| TMS Brokers | Yes | $0 | No | No |

| TP Global FX | Yes | $200 | Yes | No |

| Trade Nation | Yes | $0 | Yes | Yes |

| Trade Pro Futures | Yes | $2,500 | Yes | No |

| Trade Republic | No | $0 | No | No |

| Trade.com | Yes | $100 | Yes | No |

| Trade12 | No | $250 | Yes | No |

| Trade360 | Yes | $250 | No | No |

| Trader’s Way | Yes | $10 | Yes | Yes |

| TradeTime | Yes | $500 | Yes | Yes |

| Tradeview | Yes | $100 | Yes | Yes |

| Trading212 | Yes | €/£/$1 | No | No |

| TrioMarkets | Yes | $500 | Yes | Yes |

| TusarFX | Yes | $1 | Yes | Yes |

| UFX | Yes | $100 | Yes | No |

| UOB Kay Hian | No | $3,000 | No | No |

| Uptos | No | $250 | No | No |

| Valutrades | Yes | $0 | Yes | No |

| VantageFX | Yes | $200 | Yes | Yes |

| Varianse | Yes | $500 | Yes | No |

| Videforex | Yes | $250 | No | Yes |

| VT Markets | Yes | $200 | Yes | Yes |

| Webull | Yes | $0 | No | Yes |

| Weltrade | Yes | $25 | Yes | No |

| WH SelfInvest | Yes | €500 | Yes | No |

| Windsor Brokers | Yes | $100 | Yes | Yes |

| XGlobal Markets | Yes | $500 | No | No |

| XM | Yes | 5 $/€/£ | Yes | Yes |

| XTB | Yes | $0 | No | No |

| XTrade | Yes | $250 | No | No |

| Yadix | Yes | $100 | Yes | Yes |

| Zenfinex | Yes | $50 | Yes | No |

| Zero Markets | Yes | $200 | Yes | Yes |

| Zerodha | No | 0 | No | Yes |

| ZuluTrade | Yes | $1 to $300 (Broker choice dependent) | Yes | No |

What Is The Best Forex Broker?

There is no single top forex broker as every client has different needs, strategies and geographical locations. For example, of the top 8 brokers in South Africa, only 5 may make the list in Dubai or India, and even then they may be topped by other firms built around the local markets. So, whether you are in New Zealand, Japan, Lebanon, China, Mexico or beyond, finding the right broker will be a completely different experience. Follow our guide above for how best to compare local brokers, or see our ranked list of brokers that accept clients in your area.

Are All Forex Brokers Licensed?

Forex broker regulation is split among the various financial and geopolitical jurisdictions in the world. While most brokers will conform to rules imposed by regulatory agencies, there are some that do not. For example, some companies intentionally set themselves up in regions not affected by the ESMA but still advertise to European customers. These are generally either scams or specialist firms that provide anonymous brokering to best protect their client information through means like not requiring KYC data on account setup.

Are There Forex Brokers That Accept Bitcoin?

Forex brokers around the world accept various payment methods for funding and emptying accounts. There are many brokers that accept wire transfer and payment (debit or credit) cards, with a growing number using and accepting PayPal, Bitcoin, Venmo and other e-wallets and payment systems.

What Is The Best Forex Trading Platform?

Much like brokers, finding the best forex trading platform is a personal and subjective task. With so many commercial and private platform providers, brokers offering their own trading software and clients with unique strategies out there, there are no clear best forex trading platforms. Plus, if you are in Nigeria, Australia, South Africa, the Philippines or Canada, the range of forex trading platforms on offer will vary with the available brokers.

MT4 and MT5 are generally safe bets and strong all-rounders, but you should do your research into what is available to you, see our list of forex trading platform for more information. Platforms may also be limited by the operating systems they can run on, so if you are looking for the best option for Mac, make sure you factor this in.

What Additional Software Do Forex Brokers Offer?

Software for forex speculation is not limited to platforms and mobile apps. Signals forex trading software provides buy and sell signals, while automation systems and bots support algorithmic investment strategies. Some automated traders use a paid or free VPS, which cuts out the middle man and allows faster order execution. Before signing up for additional features, check our automated forex trading software reviews.

Best Forex Brokers 2021

The ForexBrokers.com annual forex broker review (five years running) is the most cited in the industry. With over 50,000 words of research across the site, we spend hundreds of hours testing forex brokers each year. How we test.

Are you looking to speculate that the Euro (EUR) currency will go up in value against the US Dollar (USD)? If so, you will want to trade (or spread bet) the EUR/USD currency pair. The forex market is the largest and most liquid market in the world, representing every global currency with trading conducted 24 hours a day, five days a week.

To trade forex, you need an online broker. Trading with a trusted forex broker is crucial for success in international currency markets. As a currency trader or investor, you may have specific needs related to which platform, tool, or research requirements you have. Understanding your investment style can help determine which fx broker will be best for you.

Each year, our team here at ForexBrokers.com spends five months testing the biggest names in foreign exchange and assembles a guide to the best forex brokers for forex and CFDs trading. Here are our findings for 2021.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 65% and 82% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Best Forex Brokers for 2021

- IG — Best forex broker overall, most trusted

- Saxo Bank — Best for research

- CMC Markets — Best web platform, most currency pairs

- Interactive Brokers — Great for professionals and institutions

- TD Ameritrade FX — Excellent trading platform, US only

- City Index — Great all-round offering

- XTB — Best customer service, great platform

- FOREX.com — Great all-round offering

- eToro — Best copy trading platform

Best overall — Visit Site

Regulated and trusted across the globe, IG (LSE: IGG) offers traders the ultimate package of excellent trading and research tools, industry-leading education, competitive pricing, and an extensive list of tradeable products. This fantastic all-round experience makes IG the best broker for forex in 2021. (70% of retail investor accounts lose money) Read full review

Best for research — Visit Site

For traders that can afford the USD 10,000 minimum deposit (GBP 500 for the UK), Saxo Bank offers competitive pricing, excellent trading platforms, brilliant research, reliable customer service, and over 40,000 instruments to trade. (64% of retail investor accounts lose money) Read full review

Best web trading platform, most currency pairs

CMC Markets is a globally trusted broker that delivers a terrific offering for traders thanks to excellent pricing and nearly 10,000 tradeable instruments. CMC Markets (LSE: CMCX) offers the best forex trading platform, its flagship Next Generation web app which comes packed with quality research, innovative trading tools, and powerful charting. (72% of retail investor accounts lose money) Read full review

Great for professionals and institutions — Visit Site

Professional forex and CFD traders seeking a global multi-asset broker will find Interactive Brokers offers a sophisticated, institutional-grade trading platform, and competitive fees. Interactive Brokers (NASDAQ: IBKR) offers advanced order types and access to global financial markets. (66% of retail investor accounts lose money) Read full review

Excellent trading platform, US only

With nearly 80 currency pairs to trade alongside a plethora of trading tools and research, TD Ameritrade’s thinkorswim platform provides US-based forex traders a winning experience. TD Ameritrade (NASDAQ: AMTD) also offers exchange-traded forex futures and options on forex futures, along with currency ETFs. Read full review

Great all-round offering

Backed by GAIN Capital, City Index is a trusted brand that traders choose for its advanced trading platforms, excellent mobile app, diverse market research, education, and extensive range of markets. GAIN Capital is part of StoneX Group (NASDAQ: SNEX) a Fortune 500 company.(70% of retail investor accounts lose money) Read full review

Best customer service, great platform — Visit Site

As a trusted multi-asset broker, XTB offers traders outstanding customer service and an excellent trading experience overall thanks to the xStation 5 trading platform. XTB is publicly traded on the Warsaw Stock Exchange (WSE: XTB.PL). (73% of retail investor accounts lose money) Read full review

Great all-round offering

While not a discount broker, FOREX.com is a trusted brand that delivers an excellent trading experience for forex and CFDs traders across the globe. FOREX.com is a GAIN Capital brand which is part of StoneX Group (NASDAQ: SNEX) a Fortune 500 company. (77% of retail investor accounts lose money) Read full review

Best copy trading platform

eToro is a winner for its easy-to-use copy-trading platform where traders can copy the trades of investors across over 2300 instruments, including exchange-traded securities, forex, CFDs, and popular cryptocurrencies. (67% of retail investor accounts lose money) Read full review

2021 Overall Ranking

Here are the Overall rankings for the 27 online brokers who participated in our 2021 Broker Review, sorted by Overall ranking.

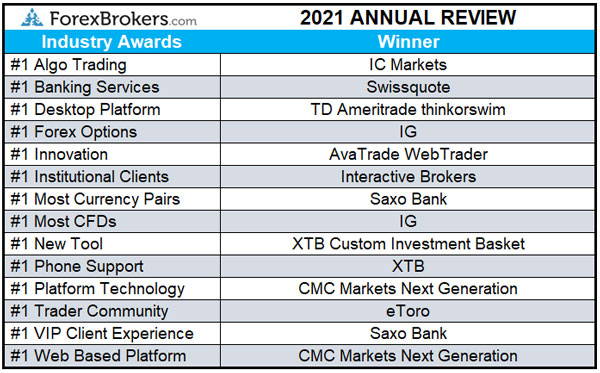

2021 Category Winners

For the ForexBrokers.com 2021 Annual Review, all online broker participants were assessed on 108 variables across seven Primary categories. 2,916 data points were collected in total. Here’s how we tested.

Alongside Primary categories, ForexBrokers.com ranks brokers by the most popular Investor categories. Finally, each year ForexBrokers.com honors the brokerages who go above and beyond in the areas that matter most to investors.

Other Forex Brokers

In addition to our top nine online brokers for 2021, there were 18 other brokerages we reviewed: Swissquote, FXCM, AvaTrade, XM Group, FP Markets, Plus500, Pepperstone, IC Markets, Tickmill, OANDA, FxPro, Vantage FX, Moneta Markets, HYCM, Eightcap, VT Markets, BlackBull Markets, and Octa FX. Here’s our high-level takeaways for each broker. To dive deeper, read our reviews.

10. Swissquote, «Traders willing to pay a premium to have their brokerage account held with a Swiss bank choose Swissquote for its competitive, multi-asset offering. That said, Swissquote’s UK-based offering provides better pricing despite offering a smaller range of markets.» Read full review

11. FXCM, «While the range of tradeable markets is narrow and pricing is just average, traders that appreciate robust trading tools alongside quality market research will find FXCM to be a winner.» Read full review

12. AvaTrade (Visit Site), «AvaTrade is a trusted global brand best known for offering traders an extensive selection of trading platform options. Our testing found AvaTrade to be great for copy trading, competitive for mobile, mostly in line with the industry average for pricing and research, and a winner for investor education.» Read full review

13. XM Group (Visit Site), «While XM Group struggles to stack up against industry leaders, in terms of its platform offering, range of markets, and pricing, XM Group provides an outstanding offering of quality educational content and market research.» Read full review

14. FP Markets (Visit Site), «While FP Markets trails industry leaders in research and education, spreads on MetaTrader are highly competitive, helping FP Markets shine as a low-cost broker for forex and CFDs trading.» Read full review

15. Plus500, «Plus500 is a trusted global brand that offers online traders an easy-to-use trading platform and a thorough selection of CFD instruments. However, Plus500 trails industry leaders in market research and advanced trading tools desired by active traders.» Read full review

16. Pepperstone, «While Pepperstone offers a small set of tradeable products, it provides one of the largest selections of third-party platforms, including multiple social copy trading options.» Read full review

17. IC Markets (Visit Site), «IC Markets caters exceptionally-well to algorithmic traders through its commission-based accounts. That said, the range of markets, and research materials offered by IC Markets are not as impressive.» Read full review

18. Tickmill (Visit Site), «Tickmill is a plain vanilla MT4 broker offering a minimal selection of tradeable securities. That said, Tickmill offers very competitive commission-based pricing for professionals through its VIP and PRO accounts.» Read full review

19. OANDA, «As a trusted global brand, OANDA provides forex and CFD traders a limited offering of FX pairs and CFDs but stands out for its reputation and quality market research.» Read full review

20. FxPro (Visit Site), «FxPro competes among the top MetaTrader brokers, offering the full suite of MT4 and MT5 platforms with multiple accounts and execution methods. The primary drawback to an otherwise balanced offering is pricing that is higher than the industry average.» Read full review

21. Vantage FX, «While offering forex and CFD traders the MetaTrader platform suite, multiple social trading platforms, and a proprietary mobile app, Vantage FX trails industry leaders in key areas, including mobile apps, research, and education.» Read full review

22. Moneta Markets «As a new standalone brand within Vantage Group, Moneta Markets struggles to compete with the industry average in the primary categories that are most important to forex and CFD traders.» Read full review

23. HYCM (Henyep Markets) (Visit Site), «While its storied history is impressive, when it comes to forex and CFDs trading in Europe and its surrounding countries, HYCM fails to impress.» Read full review

24. Eightcap, «With a small range of markets and no standout features across its research, education, platforms, and account offerings, Eightcap struggles to compete with the best forex brokers.» Read full review

25. VT Markets, «VT Markets benefits from being part of the Vantage Group of companies, yet struggles to compete with the best forex brokers due to a limited offering of research, platforms, and tools, as well as a limited range of available markets to trade.» Read full review

26. BlackBull Markets, «With just MetaTrader 4 available alongside a handful of social copy trading platforms, BlackBull Markets offers a limited product range and struggles to compete with industry-leading forex brokers.» Read full review

27. Octa FX, «OctaFX offers traders a mostly vanilla MetaTrader and cTrader trading platforms experience. Beyond its European license in Cyprus, OctaFX lacks regulation in major jurisdictions, which puts it at a severe disadvantage compared to other trusted forex brokers.» Read full review

Winner: IG

Overall — Visit Site

Regulated and trusted across the globe, IG offers traders the ultimate package of excellent trading and research tools, industry-leading education, competitive pricing, and an extensive list of tradeable products. This fantastic all-round experience makes IG the best overall broker in 2021.

- Trust: Founded in 1974, IG is publicly traded (LON: IGG) and regulated in six tier-1 jurisdictions, making it a safe broker (low-risk) for forex and CFDs trading. All jurisdictions considered, IG ranks as the most trusted forex and CFDs broker in our 2021 Review.

- Commissions: IG uses its size to provide traders competitive pricing across the board, regardless of the product you trade, and shines for its active trader pricing available through its Forex Direct accounts.

- Forex trading platforms: While IG also offers MetaTrader and premium MT4 add-ons from FX Blue, only 76 tradeable instruments are available. No question, IG’s flagship platform is the better choice between the two.

Runner-Up: Saxo Bank

Overall — Visit Site

For traders that can afford the USD 10,000 minimum deposit (GBP 500 for the UK), Saxo Bank offers competitive pricing, excellent trading platforms, brilliant research, reliable customer service, and over 40,000 instruments to trade.

- Trust: Founded in 1992, Saxo Bank operates multiple regulated banks and is licensed in six tier-1 jurisdictions, making it a safe broker (low-risk) for trading forex and CFDs.

- Commissions: Saxo Bank provides traders excellent all-around pricing. For active traders and those with large account balance traders, Saxo Bank offers the lowest pricing in the industry.

- Forex trading platforms: The entire Saxo Trader client experience is absolutely brilliant. Alongside access to trading 40,000 instruments, Saxo Bank’s flagship platform, SaxoTraderGo, is terrific, including everything traders require to navigate the market.

Also Great: CMC Markets

Overall

CMC Markets is a globally trusted broker that delivers a terrific offering for traders thanks to excellent pricing, nearly 10,000 tradeable instruments, and the Next Generation trading platform, which comes packed with quality research, innovative trading tools, and powerful charting.

- Trust: Founded in 1989, CMC Markets is publicly traded and regulated in four tier-1 jurisdictions alongside two tier-2 jurisdictions, making it a safe broker (low-risk) for trading forex and CFDs.

- Commissions: CMC Markets is a leader for low cost trading, offering trading costs for forex that are measurably lower than the industry average.

- Forex trading platforms: The CMC Markets Next Generation platform comes with a massive selection of nearly 10,000 tradeable instruments. It delivers a terrific user experience, advanced tools, comprehensive market research, and an excellent mobile app.

Best Forex Trading Platforms

- Saxo Bank — Best VIP client experience

- CMC Markets — Best web platform and platform technology

- IG — Most trusted, great for beginners

- TD Ameritrade FX — Best desktop platform (US only)

- FXCM — Well-rounded platform offering

Do I need a broker for forex?

Yes, you must use a forex broker to speculate on the price of currencies from a brokerage account. Your broker should be a trustworthy one, regulated and properly licensed in the same country you reside or in a major financial center. Learn about our Trust Score for brokers.

Are forex brokers reliable?

The most trustworthy brokers are also reliable. Reliability depends on which broker you choose, and can vary across brokers. You must be able to rely on your broker to safeguard the money in your brokerage account.

There are other trust factors to consider how dependable a broker is, such as ensuring it has adequate financial operating capital, how long it’s been in operation, and whether it holds proper regulatory licenses in the countries where it operates to help ensure compliance with local laws.

Who is the biggest forex broker in the world?

Tokyo-based GMO Click Securities is the largest forex broker by trading volume, with over $1 trillion in forex trading volume in the second quarter of 2020 alone, according to data compiled by FinanceMagnates.

For non-Japanese brokers, Sydney-based IC Markets is another high-volume broker with nearly $595 billion in trading volumes during the same 2020 period.

Note: Who the largest broker is may vary depending on what time period you measure. But common to the biggest brokers is that they have the most assets under management, biggest number of clients, and greatest market capitalization (valuation for public companies). All are important factors to consider when gauging the size of a forex broker.

What are the top 10 forex brokers?

Here are the top 10 brokers by forex and CFD trading volume according to data compiled by Finance Magnates during the first quarter of 2021 (data excludes Japan due to the abnormally high trading volumes known to come from Japanese brokers):

- IG

- Plus500

- Saxo Bank

- CMC Markets

- GAIN Capital

- FXCM

- Pepperstone

- Tickmill

- Axi

Which forex broker charges the lowest fees?

When it comes to pricing, Tickmill offers the most competitive all-in cost to trade. Tickmill offers three accounts, and no question, Tickmill is best for active and VIP traders, who have access to pricing that competes among the lowest brokers in the industry. Using typical spread data listed by Tickmill for its Pro account offering of 0.13 pips for the EUR/USD, the all-in cost equates to 0.53 pips when factoring in the RT commission equivalent of 0.4 pips.

Methodology: To assess brokers, we take into consideration how much beginners, average traders, and even more seasoned traders would pay, looking at average spreads for standard forex contracts (100,000 units) as well as mini accounts (10,000 units) and micro accounts (1,000 units), where applicable. We then calculate the all-in cost by including any round-turn commission that is added to prevailing spreads.

Which forex broker has the best platform?

The CMC Market’s Next Generation platform comes with a massive selection of nearly 10,000 tradeable instruments. It delivers a terrific user experience, advanced tools, comprehensive market research, and an excellent mobile app. Hands down, the CMC Markets Next Generation trading platform is a market leader that will impress even the pickiest of traders.

If you’re a particular fan of mobile platforms, see our picks for best forex trading apps here.

Which forex broker offers the most CFDs?

IG offers the most tradeable CFDs in the industry, 19,537. CFDs, or «contracts for difference,» enable traders to speculate whether the price of a stock, forex pair, market index, or commodity will go up or down without taking ownership of the underlying asset.

Which forex broker offers the most currency pairs?

Alongside offering over 9,000 CFDs, Saxo Bank offers the most tradeable currency pairs, 170 in total. The one caveat to Saxo Bank is the broker’s high minimum deposit requirement for non UK residents.

Which forex broker has the best customer service?

After placing 300 phone calls to assess customer service from locations across the UK, XTB offered the best phone service. Connection times were consistently less than one minute and across 13 total calls, XTB received an average Net Promoter Score of 9.0 out of 10.

Methodology: To assess customer service, ForexBrokers.com partnered with customer experience research group Customerwise to conduct phone tests from locations throughout the UK. For the 2021 Review, 300 customer service tests were conducted over eight weeks. Ten unique templates were used with three questions being asked, on average, per call.

Which forex broker is best for professionals?

CMC Markets offers active traders liquidity rebates starting at $5 per million when you surpass at least $25 million in notional trading volumes per month, to as much as $10 per million for those that trade over $300 million monthly. This program in the UK is available only to Professional Clients. Using the average spread data of 0.74 pips on the EUR/USD for August 2020, the all-in cost on the highest tier would be 0.64 pips and is comparable to similar programs offered by IG (0.59 pips) and Saxo Bank (0.6 pips).

Professional client status: In today’s highly regulated forex world, traders who want to maximize their margin leverage must apply and obtain ESMA’s professional client status with their broker. Traders designated as Professionals in the EU do not receive negative balance protection and other consumer safety mechanisms such as eligibility for compensation schemes in the event of their broker’s insolvency.

Methodology: We broke down each forex broker’s active trading program to assess brokers for professional trading, comparing available rebates, tiers, and all-in costs. Alongside pricing, each broker’s trading platform was tested for available advanced trading tools frequently used by professionals.

How do I choose a forex broker?

Here are three of the most important factors to keep in mind when choosing an online broker for forex trading.

- 1. First, make sure your broker is properly licensed and regulated. The safety of your deposit is always the top priority.

- 2. Next, compare the account offerings, trading platforms, tools, and investment research provided by each broker.

- 3. Finally, read detailed forex broker reviews to compare pricing and product offerings (e.g., number of forex pairs and CFDs available to trade) to find what is most important to your forex trading and investment needs.

How do I know if my forex broker is regulated?

It is crucial to use a well-known, properly regulated broker to avoid forex scams. To check if your forex broker is regulated, first identify the register number from the disclosure text at the bottom of the broker’s homepage. Next, look up the firm on the regulator’s website to validate the register number. If the broker is not regulated in your country, do more research. To help traders, we track, rate, and rank forex brokers across over 20 international regulators.

What’s the difference between a dealing-desk and an agency broker?

If a forex broker is operating as a dealer, also known as dealing-desk, they will be on the other side of their client’s trades. If a forex broker is not on the other side of their client’s trades, they will be acting as an agent (agency broker) by routing the trade on to another dealer.

There are also hybrid-desks, which may operate as a dealing-desk and agency. Lastly, matched-principals are dealers who immediately hedge their trades to remove any potential conflict of interest.

How do I calculate forex trading costs?

For forex and CFDs trading, the all-in cost to complete (open or close) each trade consists of the spread, plus any round-turn commissions. There may also be overnight financing charges, known as carrying costs, which can be either a net debit (loss) or a net credit (refund). To keep trading costs low, focus on trading the major forex pairs such as the EUR/USD, which offer the most liquidity, and thus the tightest spreads (lowest costs).

Read Next

Methodology

For our 2021 Forex Broker Review we assessed, rated, and ranked 27 international forex brokers over a three-month time period resulting in over 50,000 words of published research.

Each broker was graded on 108 different variables, including our proprietary Trust Score algorithm. This innovative scoring system ranks the level of trustworthiness for each broker based on factors such as licenses, regulation and corporate structure (read about Trust Score here).

As part of our annual review process, all brokers had the opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Learn more about how we test.

Forex Risk Disclaimer

«There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses.» Learn more.

Continue Reading

Источник https://www.daytrading.com/forex-brokers

Источник https://www.forexbrokers.com/guides/forex-trading

Источник

Источник